Why Invest in Renewable Energy

Europe’s energy system is undergoing its most profound transformation in decades. As fossil fuel prices remain volatile and carbon reduction targets tighten, renewable energy has emerged not just as a cleaner option but as the foundation of energy security and economic resilience.Global investment in clean energy reached 2.1 trillion US dollars in 2024, with 728 billion allocated to renewables. Market forecasts expect renewable energy to grow from 1 trillion US dollars in 2024 to over 1.5 trillion by 2032, driven by new projects, cost declines and political support across Europe.Whether you're a landowner, investor or policy-maker, renewable energy presents both immediate opportunities and long-term value.

Clean Energy Jobs

The International Renewable Energy Agency (IRENA) reports that over 13.7 million people were employed in the renewable sector globally in 2022. That number is expected to reach 38 million by 2030 under net-zero aligned pathways. Europe is already seeing job growth in wind turbine manufacturing, solar panel assembly, battery systems and hydrogen development.

Energy Independence

Reducing dependence on fossil fuel imports is now a top priority. Solar and wind have become cheaper than new gas or coal in most European countries, and they provide stable electricity prices over the long term. In addition to emissions reduction, they are a strategic tool for energy security.

Leasing land for renewable energy projects is a straightforward way to generate income without upfront investment.

Solar projects typically require between 10 and 30 hectares. Wind developments need open space and strong wind resources. Grid access and local planning rules are critical.

generally run for 20 to 30 years. Landowners receive regular payments, with returns that often exceed traditional agricultural rent.

For solar, rates typically range from €800 to €4,000 per hectare annually, depending on project type and country. Wind turbines may pay €5,000 to €10,000 per turbine per year.

should be part of every contract to protect the land after project end.

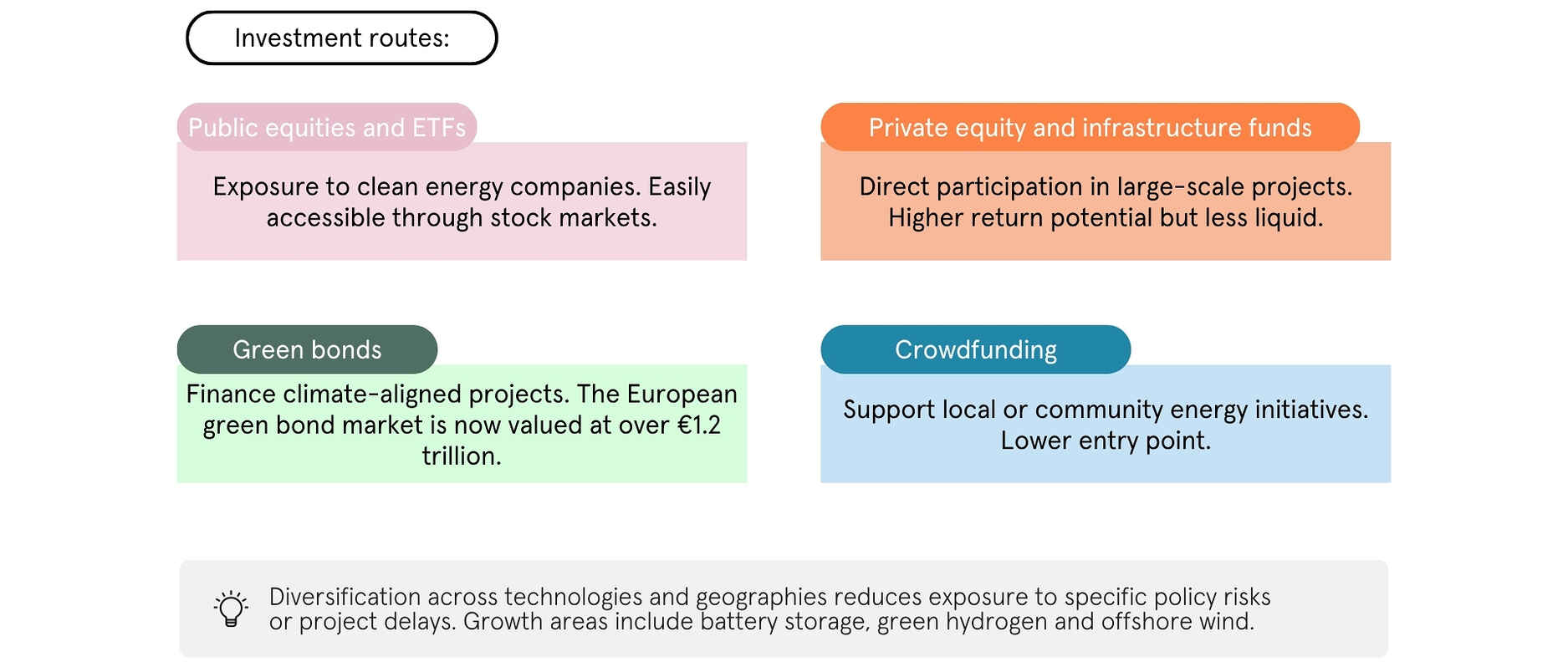

Renewables now represent one of the fastest growing investment sectors globally. Institutional and private investors are shifting capital towards clean energy for its stable returns and climate impact alignment.

Europe’s public sector plays a key role in shaping the future of energy. National governments and local authorities are using regulation and public funding to expand renewable capacity. The EU aims to reach 45 percent renewable energy in gross final energy consumption by 2030 (REPowerEU). Contract-for-difference auctions, feed-in premiums and power purchase agreements are standard tools used to de-risk projects.Programmes such as InvestEU, the Innovation Fund and the European Regional Development Fund are helping finance grid upgrades, research and pilot technologies. Public-private partnerships are increasingly used to combine private capital with strategic public oversight.

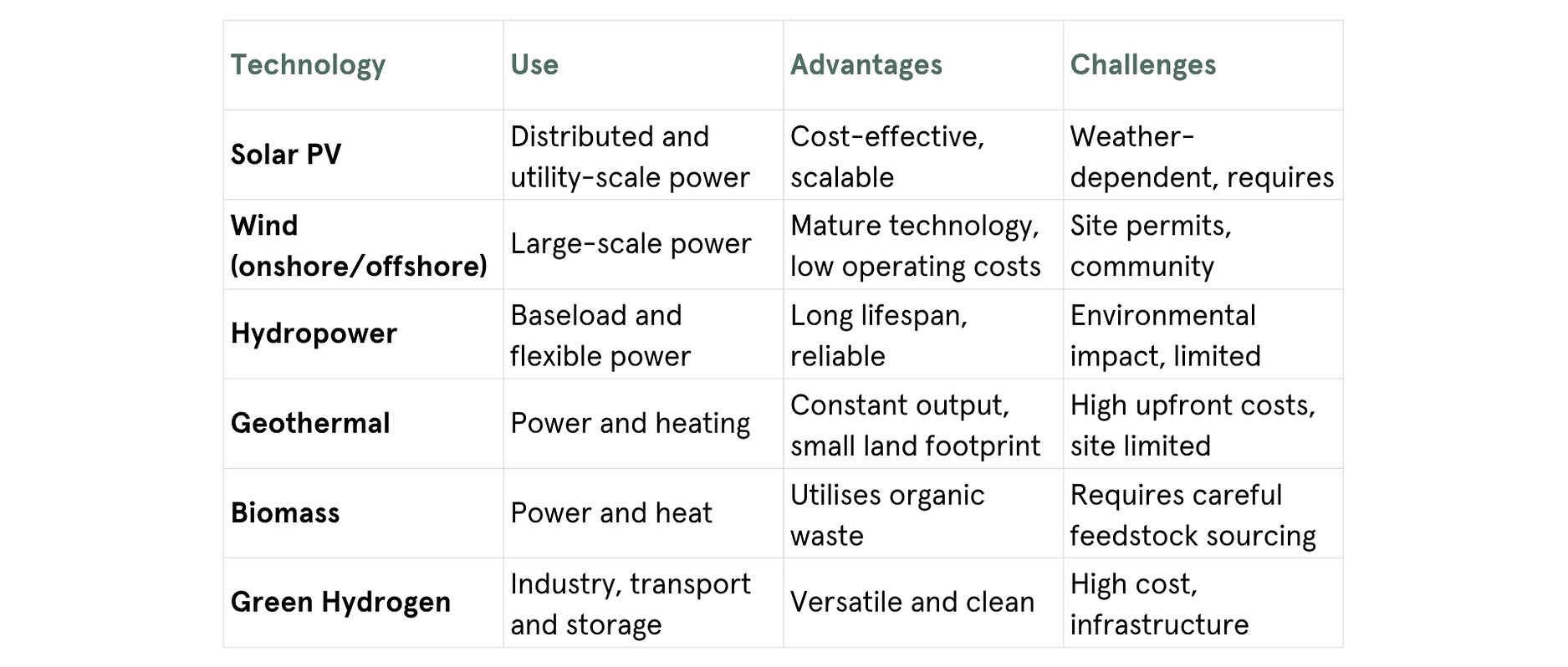

Key Technologies

Advances in electrolyser efficiency, grid balancing technologies, and hybrid renewable projects are driving clean energy, enabling low-cost hydrogen, improved stability and greater system flexibility.

Investing in or hosting renewable energy projects requires careful consideration.

is essential. Evaluate grid access, technology, regulation and the developer’s track record.

matter. From permitting and financing to commissioning and operation, each phase has specific risks.

is crucial. Work with experienced developers who understand regional planning, financing and community engagement.

Viridi as Your Partner

At Viridi, we support landowners, investors and public authorities across Europe in developing renewable energy solutions tailored to their goals. From site evaluation to financial structuring and long-term management, we bring technical and market expertise to each stage. If you're exploring your options in renewable energy, we’re here to help.